Starting a business is exciting. The UK is a fantastic place for new ventures, with a strong economy and ample support. But getting it right is crucial to avoid problems. This guide simplifies business setup UK, covering structures, registration, and growth tips in clear steps. Let’s turn your idea into a thriving reality.

Why Launch Your Business in the UK?

The UK is a hub for entrepreneurs, offering access to funding, skilled workers, and global markets. Setting up correctly is key to thriving. Choose business setup service UK for efficient paperwork management. These experts simplify legal processes, saving you time and ensuring compliance. Additionally, government support like Start Up Loans and Business Support helplines helps you launch confidently.

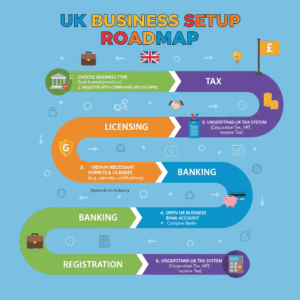

Choose the Right Business Structure

Your structure affects taxes and risks. Options include sole trader, partnership, or limited company. Each suits different goals.

Sole Trader: Simple and Flexible

A sole trader operates alone. It’s the easiest setup. Register with HMRC for taxes. You keep all profits but bear all debts. This suits freelancers or small trades like plumbers. Register within three months to pay income tax and National Insurance. Keep detailed records to simplify tax filing. Many sole traders use accounting software for ease.

Partnership: Shared Effort

A partnership involves two or more people splitting profits and risks. Choose a general partnership for equal shares or a limited liability partnership for protection. It pools skills and costs, but partners may be liable for each other’s actions. Draft an agreement to prevent disputes. Register with HMRC for taxes. Clear agreements help maintain trust among partners.

Limited Company: Built for Growth

A limited company is a separate legal entity, shielding personal finances. It’s tax-efficient and ideal for raising funds, though it involves more paperwork. Register with Companies House for about £12 online. Select a unique name and appoint directors. Annual accounts and confirmation statements are mandatory. This structure suits businesses aiming for expansion.

Register Your Business Legally

Registration makes your business official and is legally required to operate.

HMRC and Companies House

Sole traders and partnerships register with HMRC for taxes, free and online. Limited companies register with Companies House, submitting details to receive a certificate of incorporation. This confirms your business’s legal status. Check if VAT registration is needed- mandatory if turnover exceeds £90,000. Early VAT registration can help reclaim costs on purchases.

Business Bank Account

Open a dedicated bank account to keep finances clear and professional. Provide ID and business details. Many banks offer free accounts for startups, often with perks like low fees. If hiring staff, register as an employer with HMRC for PAYE and National Insurance. Separate accounts simplify audits and build credibility with clients.

Meet Legal Requirements

Compliance prevents fines and builds trust. Some businesses, like food or alcohol sales, need licenses – check with your local council. Secure insurance, such as employers’ liability for staff, which is legally required. Public liability or professional indemnity may apply, especially for service-based businesses. If handling customer data, register with the ICO to comply with GDPR rules.

Plan Finances and Taxes

Good financial planning keeps your business strong and sustainable.

Write a Business Plan

A business plan outlines goals and finances, attracting investors or lenders. Include market analysis, costs, and revenue projections. Free templates are available on Gov.uk. A clear plan helps you stay focused and adapt to challenges. Update it regularly to reflect your business’s progress.

Manage Taxes

Sole traders file annual self-assessments to report income. Companies submit corporation tax returns. Track income and expenses with tools like QuickBooks or Xero. Claim deductions for costs like travel, equipment, or supplies to reduce tax bills. An accountant can simplify complex taxes, ensuring accuracy and compliance with HMRC rules.

Avoid Common Mistakes

Careful planning prevents setbacks. Budget for unexpected costs to avoid cash flow issues. Study competitors to understand your market. Manage time effectively to balance tasks. Professional services, like accountants or setup experts, can help you avoid errors and stay on track for success.

Conclusion

Launching a business in the UK is achievable with the right steps. From choosing a structure to managing taxes, each decision builds your success. Leverage business setup UK resources and business setup service UK to streamline the process. Start today, stay focused, and watch your business grow into a thriving venture.